approximation formula finance

This example using the approximate formula would be. Jsubk Wsubk j 1h - Wsubk jh and our numerical approximation to X jh will be denoted xsup.

Pin By Studywalk On Finance Formulae Finance Net Income Repayment

Cost of debt using both methods.

. Rd 10801000 dN1000 2 2. I r π. I the nominal interest rate.

Here Y Y1 Y2-Y1 X2-X1 X-X1 To get the quantity of production required we have modified the above formula as follows X Y Y1. Section 2 derives an approximation formula for the general one-factor model of zero-coupon bonds and Section 3 presents the per-formance level for the case of the CIR model. Thus an approximation formula has the form f x f x.

Debts Recoverable from Mr. The former suggests the approximation listed in Table I as Equation 12. The approximation formula for Sf τ obtained by Zhu 2004 is 2τ γ ea Z eτ ρ f1 ρ Sf τ e sin f2 ρ dρ 2 1γ π 0 a2 ρ where Ã.

However one can also use the approximate version of the previous formula. It can be shown that a fast ie computationally cheap numerical approximation is as follows. If the underlying price S follows the dynamic specified in 31 the price of a down-and-out binary option P StX_0 can be approximated by a Fourier cosine series as 32 begin align displaystyle P StX_0frac 1 2A_0 X_0V_0sum_ k1 inftyA_k X_0V_k end align where.

B is facing some financial crisis and there is no probability of debt recovery from him. For short term options T to 0 we have SigmaTK approxeq fraclnS_0Kint_KS_0 ssigmas-1 ds known as the BFF approximation Berestycki Busca Florent - 2001. Get step-by-step solutions from expert tutors as fast as 15-30 minutes.

X 0 a Available Expressions Click Row to Add Also Known As. Linear approximation formula calculator. Discount - or Underwriting fee 25 premium Coupon interest rate Life 20 years -440 6 The after-tax cost of financing using the approximation formula is.

Plot the price difference between the exact formula and the approximation formula for the CIR model where γ 12. The price of a bond is 920 with a face value of 1000 which is the face value of many bonds. To accommodate the convex shape of the graph the change in price formula changes to.

B 220 0 probability 0. Consider a known trial rate i which is near the unknown true rate i. Change in price Modified Duration Change in yield 12 Convexity change in yield2 Change in price for 1 increase in yield -4591 12 262643 1 -446 So the price would decrease by only 4064 instead of 4183.

Here is how the bad debt expense is estimated. 4 PP - D yy ½ C yy 2. You are being redirected to Course Hero.

The approximated YTM on the bond is 1853. Round to two decimal places Cost of debt using the approximation formula For the following 1000-par-value bond assuming annual interest payment and a 28 tax rate calculate the after-tax cost to maturity. Input 30 -1080 60 1000 Function PV PMT FV CPT Solution 545 Using the approximation formula the before-tax cost of debt rd for a bond with a 1000 par value can be computed as follows.

The remainder of the paper is organized as follows. The equation for this approximation formula based on the first two terms of the Taylor series expansion of the bond price equation can be written as. Importance of Yield to Maturity The primary importance of yield to maturity is the fact that it enables investors to draw comparisons between different securities and the returns they can expect from each.

Calculate the linear approximation of the function fx x 2 as the value of x tends to 2. There are however a bunch of approximations available in the literature. C has disputed his invoice and only a 50 recovery is expected from him.

A 80 0 recovery chances 0. Your first 5 questions are on us. 1 a2 ρ 1 ρ f2 ρ 2 ρ ln b tan.

Debts Recoverable from Mr. At the end what matters is the closeness of the tangent line and using the formulas to find the tangent around the point. After solving this equation the estimated yield to maturity is 1125.

Because current market rates for similar bonds are just under 15 Warren can sell its bonds for 970 each. The formula for determining approximate YTM would look like below. Vt 1 2 1 2Tanhπd1 23St 1 2 1 2Tanhπd2 23Ke r T t 1 1 1 eπd1 3St 1 1 1 eπ d1 σT t 3Ke r T t The Logic.

1000-Nd 1000 - 1080 60 30 ooo mooo-00551 551. Power function exponential function x. In this section we present an approximation method based on the expansion of a solution of a differential equation in a series in a small parameter.

1 a2 ρ 1 ρ f1 ρ 2 b ln ρ tan 3 b ρ γ a Ã. YTM and the approximationformula Currently Warren Industries can sell 10-year1000-par-value bonds paying annual interest at a 15 coupon rate. Fx 0 2 2 4 f x 2x fx 0 22 4.

In a similar fashion the approximation of A 1 1 2 and A3 can then be derived as u0004 u0005 1 x m 1τ r td σ T D 1 2 D. R the real interest rate. Approximation Formula a mathematical formula obtained from an expression of the form f x f x x where x is regarded as the error and after evaluation is dropped.

1 i 1 r 1 π Where. Clearly one must have interest tables available in order to calculate an approximate rate according to Bailys formula or any other formula based on Method II. A mathematical formula obtained from an expression of the form f x f x x where x is regarded as the error and after evaluation is dropped.

Bonds pricing and analysis Description Formula for a quick approximation of a bonds yield. Our online expert tutors can answer this problem. Bond yield quick approximation Tags.

Given fx x 2 x 0 2. Warren will incur flotation costs of 30 per bond. Based on the above data we can estimate the quantity required to cover the cost of 900000 using interpolation formula as follows.

Assume that the annual coupons are 100 which is a 10 coupon rate and that there are 10 years remaining until maturity. π the inflation rate. The Fisher equation is expressed through the following formula.

Bailys formula can be derived as follows. Start your free trial. The closer the bond is to maturity the more precise the result.

How To Purchase A Bond Important Guidelines To Follow Maturity Guidelines Financial Advice

Time Value Of Money Financial Mathematics Icezen Time Value Of Money Accounting And Finance Finance

Yield To Maturity Ytm Approximation Formula Finance Train

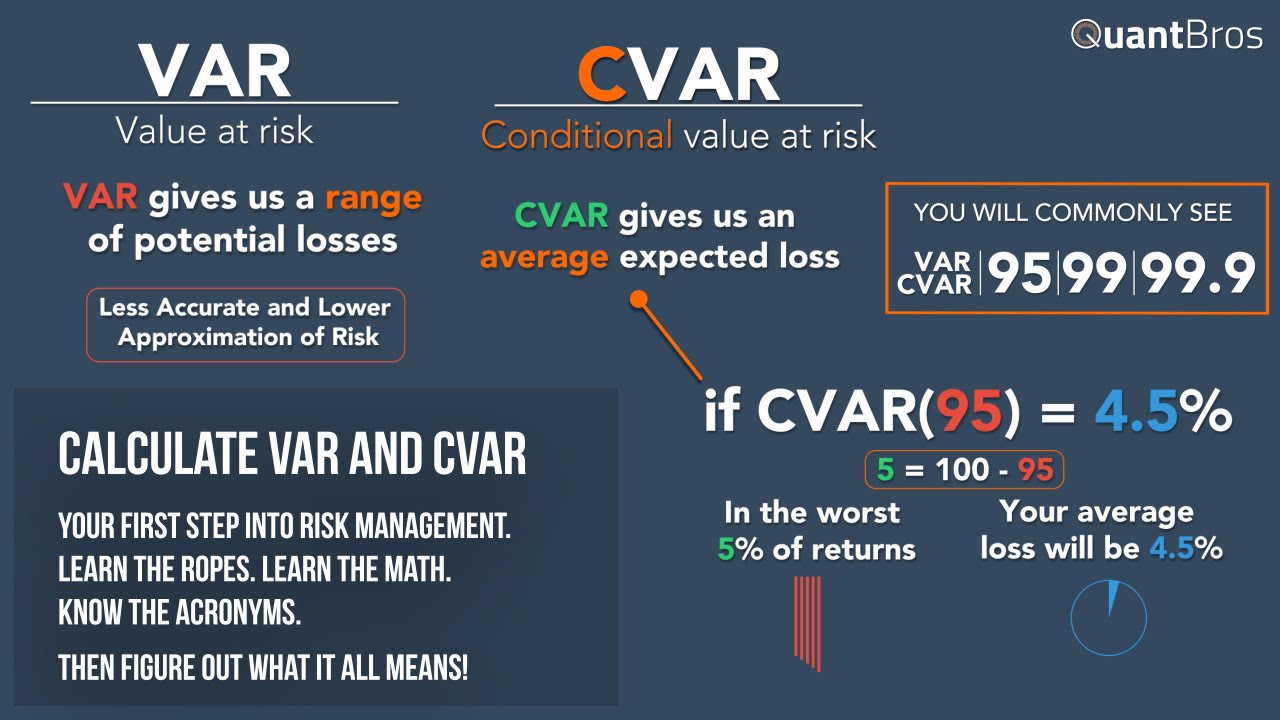

Calculating Var And Cvar In Excel In Under 9 Minutes Excel Calculator Risk Management

Learn About Straight Line Depreciation Method On Income Statements Math Problems Worksheets For Kids Method

Pin By Mount Lehman Credit Union On The Rule Of 72 Rule Of 72 Investing Rules Compound Interest Money

Yield To Maturity Ytm Approximation Formula Finance Train

Creditor Payables Days Tutor2u Business Financial Ratio Small Business Tools Economic Research

0 Response to "approximation formula finance"

Post a Comment